Is the Gold Price at a Turning Point?

Gold is in a transition phase. In the past nine months two key developments—war and inflation—have made gold trade much stronger than how it was priced from 2006 through 2021. Both developments are likely to stick around in the coming years and will prove a tailwind for gold. Moreover, the current monetary environment is adding support to the gold market as governments and central banks risk insolvency. For the medium- and long-term I’m therefore optimistic on gold. In the short-term gold still has downside risk due to rising interest rates and the possibility of collapsing asset markets triggering a liquidation event.

Is the price of gold at an inflection point?

Introduction

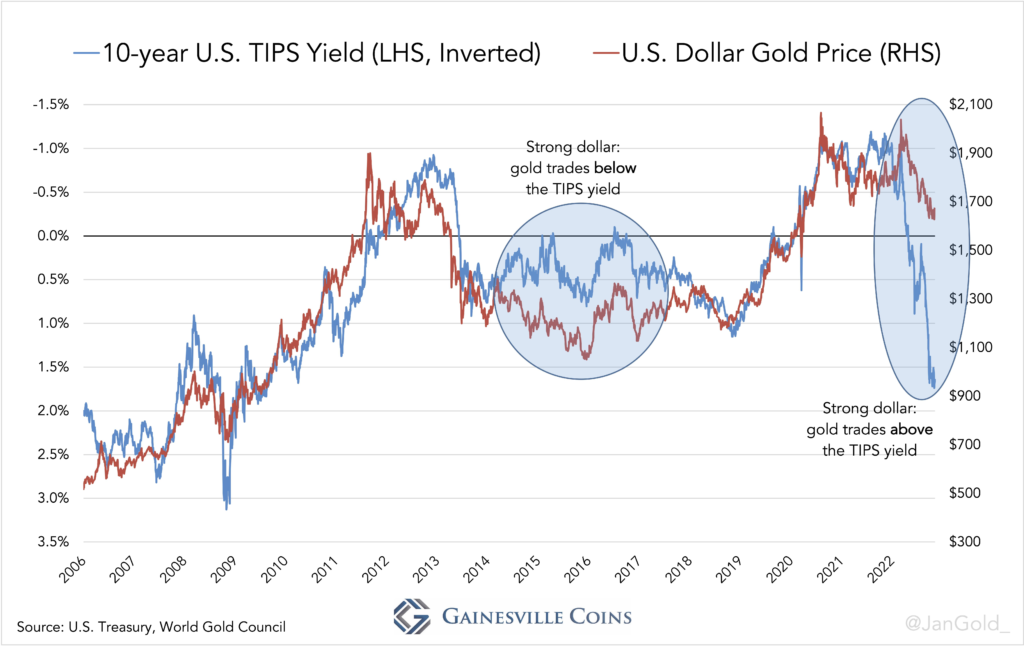

From 2006 until early 2022 the market priced the U.S. dollar gold price based on the 10-year TIPS yield, which can be seen as the expected real interest rate on 10-year U.S. government bonds, and dollar strength. In my article from January 2022 I have explained the mechanics of TIPS bonds and gold’s inverse correlation with the TIPS yield. Basically, the TIPS yield is the nominal interest rate on U.S. government bonds (the Treasury rate) minus inflation expectations.

TIPS rate = Treasury rate – inflation expectations

The correlation between gold and the TIPS yield is inverted because the lower the TIPS yield (expected real rate) the more investors are incentivized to buy gold and vice versa.

Let’s have a look at an updated chart of the 10-year TIPS yield versus gold prices.

We can see that until recently the correlation was tight. From 2014 until 2017 the gold price traded below the TIPS yield because of a strengthening dollar. Remarkably, since the war in Ukraine gold is not only trading firmly above the TIPS yield, it’s doing so while the dollar is going up. Based on how it was priced in the past 15 years gold should be trading at $800 dollars an ounce now, but it’s not. At the time of writing gold trades around $1,700. What’s going on?

War and Gold

The first development that has changed how gold is priced is Russia’s invasion into Ukraine, which set in motion a proxy war between the West and Russia. As ties between the U.S. and China are also deteriorating, for example over chip technology and Taiwan, it can be expected the division between East and West will accelerate. The consequences are that the East is hastening to de-dollarize and trade between East and West is declining. The former boosts gold as investors are looking for an alternative store of value. The latter—de-globalization—will reshore production and create new supply chains, which is inflationary and supportive for gold too.

The war made the U.S. decide to freeze dollar assets owned by the Russian central bank (CBR). This watershed moment has startled all foreign holders of dollars. Countries in the East holding large dollar reserves are warned their assets can be rendered worthless in the blink of an eye. Sovereign wealth funds and other investors are buying gold because there aren’t many alternatives for the dollar. Gold isn’t issued by any country or central bank, and thus has no political or credit risk, it’s in limited supply, it’s untraceable, and has a five thousand year track record as a store of value.

The freezing of CBR’s dollars has lowered foreign demand for U.S. Treasury bonds during a trend in which foreigners are already willing to hold less of the total U.S. federal debt. Potentially, this could lead to a funding problem for the U.S.

Recently the World Gold Council (WGC) reported central banks bought close to 400 tonnes of gold in Q3 2022, which is four times as much compared to Q3 2021 and a record since the end of Bretton Woods. Although, this number should be taken with a pinch of salt, as it’s mostly based on field research and not what central banks report to the IMF. Most people I talk to in the industry agree the Chinese central bank, and a few others, buy gold covertly. We may assume this is reflected in WGC’s estimates.

Inflation and Gold

Some investors are disappointed by gold’s performance this year because the price in dollars is down while consumer prices in the U.S. have increased by 8% year-on-year. What they fail to see is how gold was priced in recent years—based on the expected real yield—and how that is changing. Now inflation is showing to be sticky, and the world is de-globalizing, gold seems to be in a transition phase. Some entities sell gold based on the old model; others are buying based on a new model.

There are analysts that presume inflation has peaked and will sharply drop. I’m more tempted to think it will stay elevated for the foreseeable future. First, Deutsche Bank analysts researched 318 episodes across developed and emerging markets since 1920 in which inflation reached 8%. The team concludes we have passed the point of no return:

When zooming in on developed economies since the world is on fiat only money (1970), the team finds that inflation has been even stickier.

More from Deutsche Bank:

Fiscal policy has remained loose throughout this inflation shock to ease the burden of Covid and higher energy prices. Indeed even now, many European countries are still pursuing fiscal stimulus packages of various kinds to cushion their citizens from the impact of the energy shock. In the meantime, monetary policy has also been behind the curve, … And, even after the hikes we’ve already had, central bank policy rates remain incredibly negative in real terms. So, you could argue this is the loosest policy response to inflation we’ve ever seen in peacetime. … However, the current consensus expects us to be back at or even below 3% just two years after we initially moved above 8%.

Perhaps gold knows more about what’s coming than the bond market, and hence gold’s pricing model is changing. Interesting fact: before 1914, inflation was practically non-existent due to metallic monetary standards.

Second, since the pandemic several governments have taken control over the printing press. In an interview with market strategist and historian Russell Napier, he explains that while many central banks are tightening, their governments are easing through loan guarantees. Commercial banks create credit, which increases the money supply, and governments will pay the bill when the loan turns sour. “This is the new normal,” says Napier, and inflation will stay around 5% in the coming years as governments want inflation to lower their debt burden. Finding reasons to ease comes naturally for politicians with endless ambitions to win votes: reducing inequality, general investments to combat climate change, the energy transition, etc. From Napier:

Just to give you some statistics on bank loans to corporates within the European Union since February 2020: Out of all the new loans in Germany, 40% are guaranteed by the government. In France, it’s 70% of all new loans, and in Italy it’s over 100%, because they migrate old maturing credit to new, government-guaranteed schemes. Just recently, Germany has come up with a huge new guarantee scheme to cover the effects of the energy crisis. This is the new normal. For the government, credit guarantees are like the magic money tree: the closest thing to free money. They don’t have to issue more government debt, they don’t need to raise taxes, they just issue credit guarantees to the commercial banks.

Third, the world is still highly dependent on fossil fuels, for conventional energy use and to realize the energy transition, but new oil discoveries are dwindling. From Rystad Energy (June 2022):

Continuing the trend from previous years, Rystad Energy’s 2022 review shows a sizeable drop in recoverable oil resources in what could deal a major blow to global energy security. According to Rystad Energy analysis, global recoverable oil now totals an estimated 1,572 billion barrels, a drop of almost 9% since last year.

A tight oil market will persist in the coming years, driving up the price of oil, which will be passed on in prices of goods and services, further fueling inflation.

Fourth, commodity price are currently subdued because China is holding on to zero COVID policy, limiting production and thus demand for anything from base metals to oil. If China would reverse course and open up, commodity prices get a push and so too inflation.

Insolvency Risk and Gold

After 40 years of moderate inflation Wall Street is conditioned thinking inflation will always swiftly revert to 2%. This reflects strong confidence in central banks and governments. Misplaced confidence?

Now central banks are raising rates, it’s becoming ever more apparent they themselves, and governments, pose a threat to the economy. In Europe, for example, Italy has so much public debt that the ECB has virtually been the only buyer of Italian government bonds in recent years. So how is the ECB suppose to tighten (sell Italian government bonds) and hike rates without Italy going bankrupt?

Central banks that conducted Quantitative Easing (QE) in the past years and now raise rates are suffering losses due to increasing interest expenses on their liabilities. In my previous article I shared the Dutch central bank is making losses that will have a severe impact on its equity (capital). But other European central banks, the Bank of England, and the Federal Reserve have the same problem.

There are three scenarios for central banks having burned through their equity:

- Operate under negative equity and risk people lose confidence in the currencies issued by these central banks.

- Treasuries (taxpayers) recapitalize central banks’ equity. Though this option is difficult because of the currently high public debt levels.

- Use the central banks’ gold revaluation accounts to increase equity, which requires a floor under the gold price and possibly revaluing gold (explained in my previous article from November 2, 2022).

The theory of revaluing gold has gone mainstream after renowned financial journalist Ambrose Evans-Pritchard mentioned it in The Telegraph on November 7, 2022. Markets might anticipate a gold revaluation and buy gold accordingly. Additionally, they might buy gold as a safe haven for when sovereigns default and cause contagion in financial markets.

Conclusion

There is a plethora of challenges in global finance. Previous to 2022 such challenges could temporarily be resolved by QE and zero interest rate policy (ZIRP), while fundamentally making matters worse: debt levels kept going up. Due to inflation these options are lethal. There is no easy way out anymore. War, inflation, and solvency risk could be a perfect storm for gold.